Southeast Asia - A Riding Pressure For Digital Technologies Like Big Information and also Virtual Discovering

The EDTech, Venture Digital Technology, and Learning Technologies arena is exploding with growth and success. This past year alone, tech has grown by almost thirty percent in the USA alone. This is creating a big change in how educators, colleges, and universities obtain their info. The info provided is much more valuable as well as can be made use of to improve direction across the board. Companies are getting on board the "information train" as well as are trusting educators to assist them make sense of all the brand-new technologies that are altering the method individuals learn.

With a focus on innovation that is transforming the face of education and learning in this nation, there is a substantial possibility for educators to make use of the tech financial backing market. Equity capital firms are looking for businesses that will certainly make use of these patterns to enhance the top quality and also efficiency of education. There is a significant need for those in the education and learning field to embrace the new technologies and help blaze a trail onward. There are numerous chances for education and learning managers to begin a financial backing firm and gain from the growing fads in the discovering sector.

According to some estimates, the initial fifty percent of this decade looks like a gold possibility for education modern technology. Pupils are now accessing numerous sorts of details in the houses and also utilizing various tools that were formerly only offered to universities and universities. The initial wave of this brand-new education and learning modern technology was mainly in the form of software program that was made use of in the house. Nevertheless, as the first half of the years approaches, more colleges are executing the initial wave of technology ventures.

One of the crucial drivers behind the brand-new trends in education technology is that students wish to make note by themselves with digital ways. This new desire to remember electronically is being satisfied by the intro of web-based software that is easy to use as well as can integrate with e-mail and text messaging systems. There are even systems that have voice recording performance that can permit pupils to videotape talks or audio files as well as 4�Y move them into memory card format. These tools are also coming to be much easier to utilize and also have the capability to record video and photo material.

An additional vehicle driver behind the growth of technology in the last years is the integration of large information right into the class. Generally, the most significant influence in just how a pupil discovers has actually originated from standard methods such as books and also reading. Many thanks to the explosion of on-line understanding, trainees have the ability to gain from real life experiences. This suggests that pupils are able to make use of large information devices such as stand out as well as various other spreadsheets to compare various training courses as well as experiences.

Because the beginning of the 21st century, there has been a rise in the quantity of cash that has actually been invested in the education market. Venture capital companies are jumping in the education industry too. There are much more financial investment possibilities in the K-12 education field and also there are fewer chances in the higher education sector. However, the variety of students signing up in higher education programs is increasing at a fast rate. Therefore, financial backing companies are beginning to concentrate their attention on the K-12 education sector.

In the education and learning industry there are lots of emerging markets that are being served by education technology. Southeast Asia is one such market. There are numerous colleges in the area and also most of them are providing online and also correspondence course innovation. There are likewise personal as well as federal government organizations that have initiated state-of-the-art infrastructure for this market. This has actually made for an extremely prosperous market for investor to enter.

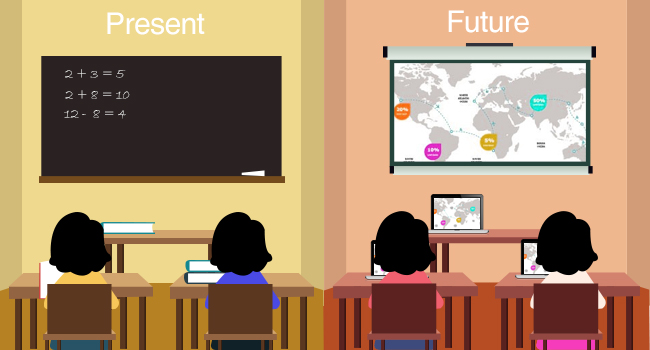

The greatest challenge for the technology industry will certainly be to remain to distinguish itself versus the currently established gamers in the marketplace. It will certainly be important for the industry to take on sophisticated technologies like big data and digital knowing in order to differentiate itself from the conventional modes of mentor. Another point that will aid move the sector additionally is the adoption of new turbulent modern technologies like the cloud, software as a solution (SaaS), venture source preparation software application, and education and learning innovation that aid in the electronic makeover of the class. Since most of individuals currently take part in e-learning tasks, the fostering of cloud computer will certainly make it easy for trainees to accessibility training courses online. This will certainly allow people to access training courses in different regions without needing to travel or invest in traveling expenses.

Education Financial Backing

Whether you have a high-end technology concept or otherwise, but additionally wish to create a system for informing others, then an EdTech Investor might be right for you. Brightlight Ventures is currently the leading and just worldwide upright EdTech financial backing firm in Europe. If you have a suggestion to change discovering as well as training, desire to speak with you soon! If so, after that why not look at our UK workplace? We give all the needed tools as well as solutions to aid you obtain your business up and running in no time in any way.

As a tech financial backing firm, we have a number of different investment options that match individual requirements, as well as offering funds for those that we assume will be a successful organization. Our initial fund, the Treadstone Accelerator Program was moneyed in late 2021 as well as has until now provided over EUR 600 million in equity capital financing. We lately completed a financing round second, generating over EUR 800 million. Both these funds are aiding us to accomplish market infiltration, greater value for our financiers as well as a wider circulation of our services.

In the very first fifty percent of this year, we made a major investment in our European education and learning innovation development facility in Bracknell. This has resulted in significant development and a variety of brand-new divisions to take care of the growing needs. We currently have more than twelve departments as well as are now taking a look at additional capability to take care of the recurring need from added nations in the second fifty percent of this year. We are really delighted with the outcomes and eagerly anticipate the new chances which will occur from this outstanding growth.

From an investor's viewpoint, there are several advantages in making an investment in technology venture capital investments. Firstly, there is considerable development capacity with the number of tools being included yearly. Second of all, some countries such as China are rapidly embracing advanced innovation as well as the framework needed to support it. Finally, the price financial savings that these tools offer means that they can be manufactured at reduced costs than equal products from typical sources.

The essential locations of emphasis for investors in the education field include production, logistics, diagnostics, diagnostic examination equipment, software, educational and also interaction hardware, telecoms, software program, Internet gain access to and tools. In addition to these, we will certainly continue to expand right into other areas such as healthcare, commercial automation as well as commercial training tools. Venture capital capitalists are normally high total assets individuals that have a proven performance history in structure organizations and attaining very high returns.

Education financiers can also expect excellent returns as the education industry itself is expanding internationally and coming to be more vital in supplying quality training and research study. The challenges that face this market are huge as well as will just be resolved with international partnership and investment. Equity capital is specifically looking for business that can demonstrate management of the whole procedure and that possess the capacity to scale up this financial investment as the world's education and learning demands boost.

For years, the education and learning market has actually been thought about a specific niche and also reasonably unattainable to start-ups. Nonetheless, as the Internet ends up being a lot more ubiquitous, the obstacles to access are lessened. It is progressively feasible for a startup to enter a market and also compete with established players. The best way for traditional venture capital capitalists to gain access to this market is to identify startups that provide an actual opportunity for earnings growth with a strong http://www.thefreedictionary.com/edtech venture capital future development strategy. These companies will probably be approached by angel financiers, private equity firms and also various other third party funding resources.

The international education market supplies a variety of opportunities for personal resources capitalists to take part in this exciting growing market. Venture capitalists need to aim to sustain business which have an outstanding administration team and a clear plan to attain growth. They need to not buy business without clearly detailing their growth plans as well as the awaited return on their invested resources. Education capitalists can accomplish the exact same goals by concentrating on those firms that demonstrate solid management groups and the decision to make their services or product a success tale. Whether they choose to money start-ups within their very own nation or abroad, education and learning financiers will require to remain abreast of the most up to date advancements in the global education market and stay knowledgeable about the most up to date trends in the investment globe.

Financial Backing and also Education in the First Fifty Percent of the Next Decade

EDTech Venture Capital is a relatively new term coined by venture capitalists in the education and learning sector to describe early-stage modern technologies that will be appealing to the investment neighborhood. These early-stage modern technologies are ones that have actually not gotten to the point of industrial manufacturing yet and also consequently are not considered "cutting-edge" adequate to draw in standard financial backing. This can be viewed as an endorsement of these sorts of innovations by the majority of investor. Nevertheless, it is essential for education industry stakeholders to understand the distinction in between edtech and also other such terms.

There are specific similarities in between tech equity capital as well as angel investment. Education and learning field financiers agree to fund companies based upon the possibility for income as well as their need to be associated with early-stage growth. As in the case of an angel financier, education and learning market funding of start-ups calls for a high return on the financiers' investment.

It is estimated that there could be as long as one hundred billion RMB invested in the education and learning market in China over the next three years. The largest source of this financing, however, is federal government organizations/agencies. While the United States has commonly had a huge amount of private funding in the type of financial backing and also bank loans, the number of government-backed Chinese start-ups has actually been substantially decreased in the previous year. Some analysts believe that the decrease in UNITED STATE federal government funding for start-ups can be credited to the brand-new administration's concentrate on advertising production in the USA, while others believe that this might merely be an early reflection of the transforming Chinese demographics.

In the recent past, the majority of education field equity capital financiers were commonly individuals with ties to the Chinese government or various other Chinese-headed companies. This fad has been transforming over the past two to three years. While there are lots of people in the education sector who are straight tied to the Chinese government, this emphasis tends to be concentrated within the HMOs or health care organizations (HMOs) in China. These companies have historically given low cost or cost-free medical care to rural Chinese people, yet they have actually likewise typically been reluctant to offer resources to new small firms in the education industry, such as schools in China. Because of this hesitation, a lot of high-end education and learning systems from the United States and also abroad have actually typically sought to Chinese financial institutions and also various other 3rd party sources for private capital financing for their high end start ups. In reaction, many Chinese banks have become progressively available to financing even more high-end education start ups, which have assisted raise the funding costs of higher end education in China for the very first time.

There is no question that China has actually drastically changed the way companies operate there. The economic situation currently is the largest in the world, and there are clear signs that the Chinese customer is getting locally created goods at a degree not seen for decades. Nonetheless, there are additionally an expanding variety of indications that the rapid rate of adjustment is changing the nature of China's financial backing financial investments. In the initial half of the decade, most of the financial backing financial investments by Chinese companies were concentrated in modern technology locations such as Web marketing, hardware and also software program, and consumer electronics.

Today, the emphasis of most exclusive resources financing goes more to what I call "2nd generation" technologies. These are modern technologies that are straight associated with what consumers want, yet that have actually not been created yet. Examples include: electronic signs, Net of Points (IoT), wearables, as well as digital residence devices. One more trend that has emerged with the development of the Chinese economic climate has actually been a raised focus on domestic production rather than worldwide sourcing. This can be seen in the types of products being presented into the China retail market: even more neighborhood, much more appealing items with lower prices.

China is not the only prospective resource for lower cost education technology. Indian business, https://en.wikipedia.org/wiki/?search=edtech venture capital for instance, have actually been establishing items that interest the preferences of the Chinese customer. Recent surveys by IDC, a global market research company, found that most of Indian students desired much more worth from their education and learning innovation. Of those evaluated, two-thirds anticipated their education and learning innovation to assist them locate a work in China, as well as another third stated that it would certainly make them extra experienced regarding the Chinese economy.

In coming months and also years, we will progressively see the growth of Chinese companies within the UNITED STATE and also European markets. Some analysts feel that there will certainly be an inevitable marital relationship in between India as well as China in the following 5 to 10 years. Will the very first half of the years to see a rise in investment in the first degree of education and learning modern technology or will it be all about tools? Only time will inform. One of the most hopeful forecasts originate from those who have the calls and the expertise. For now, let's all stay client as well as anticipate a bright and bright future for this as well as all of our nations financial https://legoventures.com and social funding.</